On 18 December 2025, the Vietnamese Government issued Decree No. 323/2025/ND-CP, on the establishment of Vietnam International Financial Center (IFC) (“Decree 323”). Decree 323, along with National Assembly Resolution No. 222/2025/QH15, marks a once-in-a-lifetime institutional breakthrough aimed at elevating Vietnam on the global financial map. Notable points:

- The “One Center, Two Locations” Model

Decree 323 establishes the Vietnam IFC as a unified legal entity operating across two strategic locations. While it is a single center with unified standards, each location has a distinct developmental focus:

- Ho Chi Minh City (HCMC): Developed as a large-scale, comprehensive financial hub with a focus on capital markets and traditional financial ecosystems.

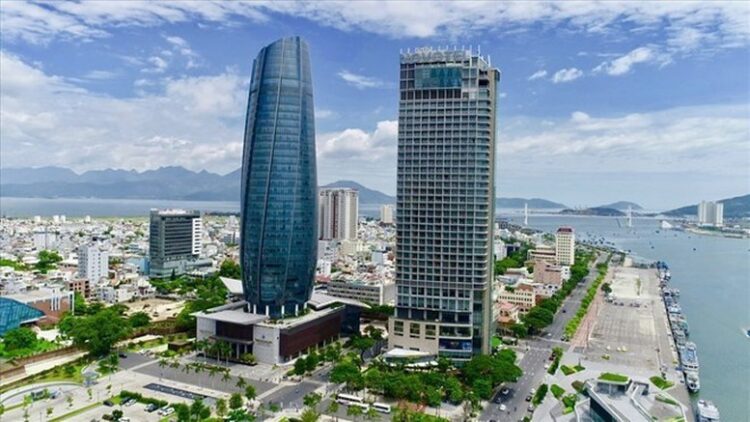

- Da Nang City: Developed as a modern hub integrated with innovation, digital technology, and logistics-linked finance.

- Strategic Footprint in Ho Chi Minh City

The HCMC IFC is designed to be the “Wall Street of Southeast Asia,” spanning approximately 898 hectares in Saigon Ward, Ben Thanh Ward, and the Thu Thiem New Urban Area.

- Prioritized Business Activities

Decree 323 explicitly lists the sectors and services that will receive priority for development and licensing within the IFC.

- IFC Infrastructure Development

- Construction and operation of IFC physical infrastructure;

- Development of digital infrastructure, digital assets, financial logistics infrastructure, payment connectivity, and cross-border transactions;

- Development of fintech ecosystems;

- Construction and operation of multi-asset depository, clearing, and settlement centers.

- Green Finance and Environmental, Social, and Governance (ESG)

- Market organization, market support services, and trading of green and ESG debt and equity instruments, as well as green/ESG financial products;

- Market organization, market support services, and trading of green assessment products, ESG ratings, and sustainability indices;

- Provision of infrastructure, registration, depository, clearing, and settlement services; organization of domestic and international carbon credit trading markets;

- Insurance and reinsurance for natural disasters and climate change risks;

- Provision of financial services supporting sustainable tourism and green tourism infrastructure funds;

- Provision of green credit rating services, ESG ratings, and sustainability indices.

- Commodity Markets, Derivatives, and International Trade Finance

- Market organization, market support services, and provision of supply chain finance solutions, trade finance, and ESG-related services;

- Corporate financial products, including trade finance, structured commodities, and commodity derivatives;

- International trade insurance, reinsurance, brokerage, maritime transport insurance, and maritime finance;

- Regulatory sandbox pilots for blockchain-based trade finance products;

- Credit extension, including import-export loans, bank guarantees, letters of credit (L/C), factoring, discounting, and ancillary services;

- Trading of international financial derivatives, including equity and index derivatives;

- Banking services as prescribed for the International Financial Center.

- Fintech and Innovation

- Provision of infrastructure and trading of digital asset products, services, and decentralized finance (DeFi);

- Provision of securities trading infrastructure for SMEs and innovative startups;

- Regulatory Technology (RegTech) solutions, including: Anti-Money Laundering and Countering the Financing of Terrorism (AML/CFT); Know Your Customer (KYC) and Know Your Business (KYB); data management; personal data protection; cybersecurity; and fraud management;

- Infrastructure, platforms, and services related to capital markets and fund management, including crowdfunding, personal finance, wealth management technology (WealthTech), robo-advisory, and alternative trading systems (ATS);

- Research into emerging financial products: asset tokenization and stablecoins;

- Development and provision of financing platforms, including supply chain finance, accounts receivable financing, and inventory-based financing;

- Development of corporate financing by non-depository lending institutions, including factoring, finance, and financial leasing companies;

- Provision of digital banking infrastructure, platforms, and services, including: remittances, payments, integrated payments, digital lending, and Buy Now Pay Later (BNPL);

- Provision of InsurTech infrastructure, platforms, and services, including open insurance, embedded insurance, insurance lifecycle innovation, and cyber insurance;

- Development of incubators, innovation hubs, and R&D centers focusing on ClimateTech, GreenTech, Web 3.0, quantum technology, and other disruptive technologies;

- Investment in and construction of digital technology industrial infrastructure.

- Investment Funds and Asset Management Services

- Fund management, fund administration, fund certificates, and collective investment schemes;

- Family office services, brokerage, and private/institutional wealth management;

- Digital technology funds, green funds, ESG funds, and green tourism infrastructure investment funds;

- Venture capital (VC), private equity (PE), and hedge funds;

- Cross-border fund depository and administration services.

- Professional Support Services and Other Sectors

- Corporate compliance support services, including: AML/CFT, KYC/KYB, data analytics and management, personal data protection, cybersecurity, and fraud management;

- Credit rating services, asset valuation, corporate disclosure services, accounting and auditing, and due diligence and certification services;

- Risk advisory, market research, and international portfolio management; cross-border Mergers and Acquisitions (M&A) advisory;

- Legal services, international arbitration, and financial/commercial dispute resolution; tax services and financial consultancy based on international standards; operational support for financial institutions;

- Investment in infrastructure for financial and fintech training, examination centers, and international certification bodies;

- Services related to financial crime compliance, such as: AML/CFT measures; FATF (Financial Action Task Force) recommendations; and other related compliance activities.

- Governance & “One-Stop” Administration

- Unified Regulation: All standards, licensing criteria, and operational rules are applied simultaneously at both HCMC and Da Nang sites to ensure consistency.

- The Executive Agency: HCMC has established a dedicated Executive Agency to act as the single point of contact for investors, streamlining the “one-stop-shop” mechanism for administrative procedures.

- Investors looking to participate must apply for IFC Membership, which grants access to the specialized legal regime.

***

Please do not hesitate to contact Dr. Oliver Massmann at [email protected] if you have any questions. Dr. Oliver Massmann is the General Director of Duane Morris Vietnam LLC.